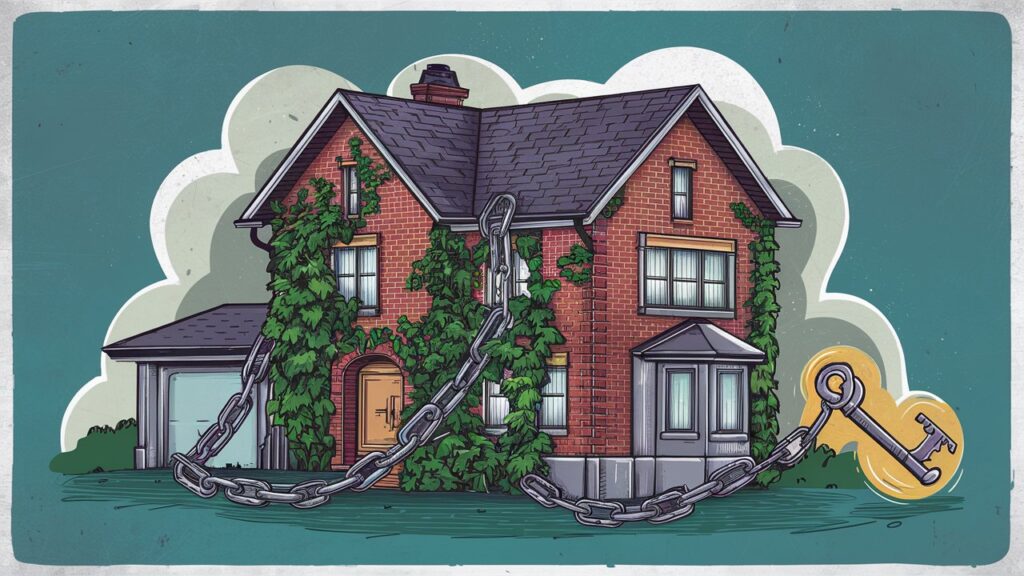

Yes, you can use your car as collateral for a loan, known as a title loan. This allows you to borrow money based on the vehicle’s value, but be aware that failure to repay the loan can result in losing your car.

Introduction

In the financial landscape, leveraging assets to secure funding is a common practice, and for many, their car is a valuable asset that can be used in this manner. Using your car as collateral for a loan is a viable option for individuals seeking immediate financial relief or aiming to finance a significant investment. This approach offers the potential to access funds by pledging your vehicle’s title, underlining a strategic way to navigate personal finance challenges while acknowledging the associated risks.

Types of Loans That Accept Cars as Collateral

These loans use your vehicle as security, offering access to funds when needed most, albeit with varying terms and conditions.

Secured Personal Loans

Secured personal loans allow you to borrow money using your car as collateral for various purposes. This option typically offers lower interest rates than unsecured loans, as the lender has the added security of your vehicle. It’s a versatile choice for borrowers financing big-ticket items or consolidating debt.

Title Loans

Title loans are a quick and straightforward option for those questioning, “Can I use my car as collateral for a loan?” You receive a loan amount based on the car’s value by temporarily handing over your vehicle’s title. These loans are known for their fast approval process but come with high-interest rates and the risk of losing your car if you default.

Pawn Loans

For individuals seeking an immediate cash flow solution, pawn loans are an option where your car is the pawned item. Unlike title loans, pawn loans may require you to hand over the vehicle for the loan duration physically. This type of loan is typically for smaller amounts and shorter terms, offering a quick but costly financial fix.

Eligibility Criteria for Using a Car as Collateral

These benchmarks ensure that your vehicle qualifies as collateral, safeguarding the interests of both the borrower and the lender.

Ownership Requirements

A fundamental prerequisite is clear ownership of the vehicle. You must hold the title outright without any liens or ongoing financing. Lenders require proof of ownership to ensure that the car can legally be used as collateral, providing a clear path to claim the asset if the loan is not repaid.

Vehicle Condition and Value Assessment

The condition and value of your car play a significant role in securing a loan. Lenders typically appraise the vehicle’s market value, considering factors like age, mileage, and overall condition. A well-maintained car of higher value increases your chances of loan approval and potentially more significant loan amounts.

Insurance Requirements

Maintaining comprehensive and collision insurance is often a stipulation for using your car as collateral. This insurance protects the lender’s interest in the vehicle, covering potential loss or damage. Proof of an active policy is usually required during the loan application.

Lender-specific Criteria

Besides the general requirements, lenders may have additional criteria, such as minimum income thresholds, credit score considerations, or employment verification. These vary by lender and are designed to assess the borrower’s ability to repay the loan, further securing the lending agreement.

Advantages of Using a Car as Collateral

These advantages range from potentially more favourable loan terms to accessibility for a broader range of borrowers.

Potentially Lower Interest Rates

Securing a loan with your car can lead to lower interest rates than unsecured loans. Lenders view collateralized loans as less risky since they have a tangible asset to recover in case of default. This reduced risk often translates into more favorable interest rates for the borrower, making the repayment more manageable over the life of the loan.

Higher Loan Amounts

Using your car as collateral can also unlock higher loan amounts. The value of your vehicle directly influences the potential loan size, offering you access to more substantial funds than unsecured options might provide. This can be particularly beneficial for covering more considerable expenses or consolidating debts into a single, more significant loan.

Easier Qualification for Borrowers with Less-Than-Perfect Credit

Securing a loan can take time and effort for borrowers with less-than-perfect credit scores. However, offering your car as collateral can ease this process, as lenders are more inclined to approve loans with a tangible asset backing them up. This opens up avenues for financing that might otherwise be inaccessible, providing a lifeline for those needing financial support despite their credit history.

Risks and Considerations

This critical evaluation ensures informed decision-making, mitigating potential financial setbacks.

Risk of Repossession

The most palpable risk involves losing your car to repossession if you cannot fulfil the loan repayment terms. This consequence affects your mobility and can add to your financial strain by removing a valuable asset from your possession. Assessing your repayment capability before securing a loan with your vehicle is vital.

Depreciation of the Car’s Value

Cars depreciate over time, and this natural decrease in value can complicate the loan’s terms, especially if the loan tenure is lengthy. Depreciation might result in owing more than the car’s current market value, a scenario known as being “upside down” on the loan. This depreciation risk underscores the importance of considering the loan’s duration and the car’s projected value over time.

Impact on Credit if Unable to Repay

Please repay the loan not only risks repossession but can also harm your credit score. Late payments or defaulting on the loan will be reported to credit bureaus, potentially hindering your ability to secure loans in the future. Maintaining a proactive approach to repayment can mitigate this risk.

Potential for Higher Costs with Certain Types of Loans

Specific loan types, particularly title loans, are notorious for their high-interest rates and additional fees. These costs can accumulate quickly, making the loan significantly more expensive than anticipated. Borrowers must scrutinize the loan’s terms, including interest rates and fees, to avoid falling into a financially precarious situation. This awareness can prevent the loan from becoming more burdensome than the initial financial need it was meant to address.

The Loan Process Using a Car as Collateral

Engaging in securing a loan using your car as collateral requires understanding each step, from application to repayment, ensuring clarity and preparedness throughout.

Application and Documentation Requirements

The initial step involves completing an application and providing necessary documentation, typically including proof of ownership (car title), identification, proof of income, and sometimes proof of residence. This phase is crucial for establishing eligibility and the loan’s feasibility based on your financial situation.

Vehicle Inspection and Appraisal

Following application submission, the next step is the vehicle inspection and appraisal. This process evaluates the car’s condition, make, model, mileage, and other factors to determine its value. The appraisal outcome significantly influences the loan amount, underscoring the importance of maintaining your vehicle in good condition.

Loan Approval and Funding Timeline

Once the application and vehicle appraisal are complete, the loan undergoes a review for approval. This phase can vary in duration but is generally swift, especially with title and pawn loans. Upon approval, the funding timeline is often short, with funds becoming available within days, offering quick financial relief.

Repayment Terms and Conditions

Understanding the repayment terms and conditions is vital before finalizing the loan. These include the interest rate, monthly payment amount, loan duration, and any potential penalties for early repayment or late payments. Clear comprehension of these terms can prevent unforeseen challenges during the loan period, ensuring a smoother financial management experience.

Alternatives to Using a Car as Collateral

Exploring alternatives to using your car as collateral for a loan can provide viable options, offering financial solutions without the risk of losing a valuable asset.

Unsecured Personal Loans

Unsecured personal loans do not require collateral, presenting a less risky option for borrowers. While these loans may come with higher interest rates due to the increased lender risk, they eliminate the worry of asset repossession. Ideal for individuals with good credit can cover various expenses, from debt consolidation to home improvements.

Credit Card Cash Advances

Credit card cash advances offer immediate access to funds up to a specific limit of your credit line. This option is convenient but usually has high-interest rates and additional fees. It’s best suited for short-term financial needs, where you can repay the advance quickly to minimize interest accrual.

Borrowing from Friends or Family

Borrowing from friends or family can be a no-cost or low-cost alternative, often without traditional loans’ formalities and interest rates. This option requires clear communication and a mutual agreement on repayment terms to avoid personal conflicts. It’s a valuable choice for those who have reliable relationships and wish to avoid the potential financial strain of formal loan arrangements.

FAQs

Can any car be used as collateral for a loan?

Not all cars qualify as collateral. The vehicle must be owned outright, meet specific value and condition criteria, and sometimes be within a particular age or mileage range.

What types of loans can I secure using my car as collateral?

Using your car as collateral, you can secure various types of loans, including secured personal loans, title loans, and pawn loans.

Can a car be used as collateral if it’s still under finance?

Generally, no. It would help if you typically had clear ownership to use your car as collateral, meaning the car is fully paid off and not currently financed.

What happens if I can’t repay the loan?

If you cannot repay the loan, the lender has the right to repossess your car, sell it, and use the proceeds to cover your debt and any associated costs.

Will using my car as collateral affect my credit score?

Taking out a loan using your car as collateral can impact your credit score, particularly if you fail to repay timely or default.

Can I still drive my car if I use it as collateral for a loan?

Yes, in most cases, you can continue to use your car as usual, even when it serves as collateral for a loan, except in the case of some pawn loans where the lender may require physical possession of the vehicle.

Conclusion

Utilizing your car as collateral for a loan can be a strategic financial move, offering access to needed funds while potentially securing favourable loan terms. However, it’s crucial to approach this decision with caution, fully understanding the risks, such as repossession and credit impact, and ensuring the loan’s terms align with your financial capability. By carefully considering the benefits and potential downsides, you can make an informed choice supporting your financial health and future goals.