An increase in your total loan balance can result from accruing interest, late fees, or capitalizing interest, which is when unpaid interest is added to the principal amount of your loan, thus increasing the overall amount you owe.

Introduction

Understanding the factors that can increase your total loan balance is crucial for effective financial management. While loans are often essential for significant purchases or educational investments, they can grow beyond the original amount borrowed due to various factors. These include the accumulation of interest over time, late payment fees, and the capitalization of interest, which adds any unpaid interest to the loan’s principal. Such increases can significantly impact your repayment strategy and overall financial health.

Principal Borrowed

Understanding the principal borrowed is vital to comprehending what increases your total loan balance. This encompasses the initial amount loaned and any subsequent borrowings or top-ups that may escalate the owed sum.

Initial Loan Amount

The initial loan amount is the foundation for your loan balance. It’s determined at the loan’s inception and directly influences the total interest accrued. This figure sets the baseline for your repayment journey, impacting your financial planning and obligations.

Additional Borrowing or Loan Top-Ups

Additional borrowing or loan top-ups refer to any extra amounts taken out on top of the original loan. These can be due to various needs, such as unforeseen expenses or further investments. Such increments directly add to the principal amount, increasing the total loan balance. This growth not only extends the repayment period but also amplifies the total interest due, affecting the overall cost of the loan.

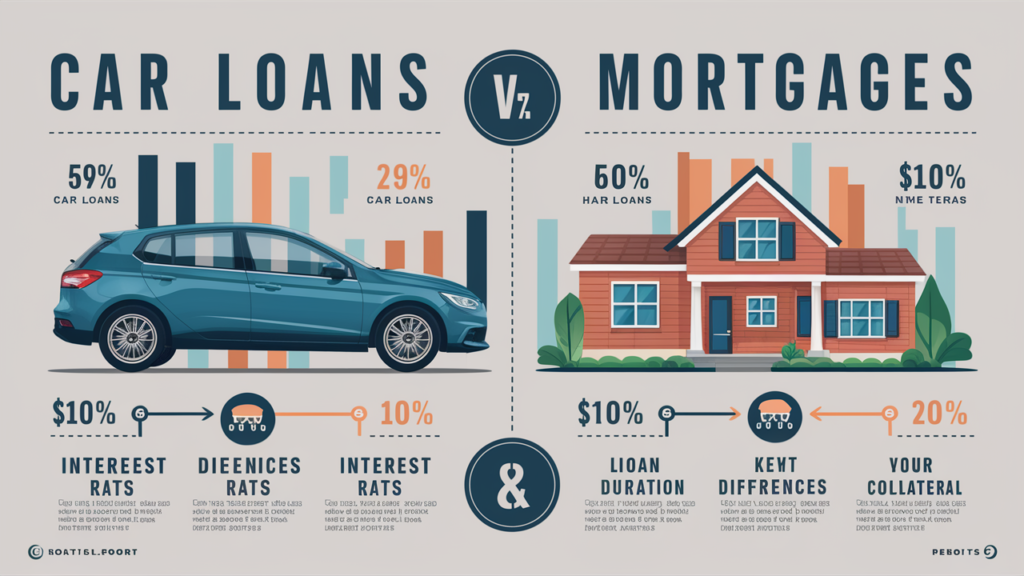

Interest Rates

The interest rate on a loan is a critical factor that dictates the cost of borrowing, directly influencing what increases your total loan balance. It affects both the monthly payments and the total amount to be repaid over the life of the loan.

Fixed Interest Rates

Stable interest rates persist unchanged throughout the entirety of the loan term. This consistency offers stability, as borrowers know how much they must repay each month. Such rates shield borrowers from market fluctuations, ensuring their loan balance doesn’t increase unexpectedly due to interest rate hikes.

Variable Interest Rates

Unlike fixed rates, variable interest rates can change over time based on market conditions. While they may start lower, they can increase, potentially raising monthly payments and the total loan balance. This variability introduces a degree of uncertainty in borrowers’ financial planning.

Impact of Rising Interest Rates on Loan Balance

Escalating interest rates exert a notable influence on loans with variable rates. As rates climb, so do the interest charges on the loan balance, which can increase the total amount owed. This situation is particularly challenging for long-term loans, where even small rate increases can substantially affect the total repayment amount. Understanding how interest rates affect your loan balance is crucial for managing and mitigating financial risk.

Loan Fees and Charges

Loan fees and charges are additional costs associated with borrowing that can significantly increase your total loan balance over time. These fees can vary widely and impact the overall cost of the loan.

Origination Fees

Lenders levy origination fees to offset the handling of new loan application expenses. Typically calculated as a percentage of the total loan amount, this upfront cost directly adds to the initial balance of the loan. It’s essential to consider these fees when calculating the actual cost of borrowing, as they can significantly impact the overall loan expense.

Late Payment Fees

Pay fees are incurred When a borrower neglects to promptly fulfil a scheduled loan payment. These fees are added to the loan balance, increasing the total amount owed. Regular occurrences of late payments can lead to a substantial increase in the loan balance due to these additional charges.

Non-Sufficient Funds (NSF) Fees

NSF fees are charged when a borrower’s payment fails due to insufficient funds. Like late payment fees, NSF fees are added to the total loan balance, increasing the amount owed. These fees emphasize the importance of managing your finances to avoid additional costs.

Prepayment Penalties

Specific lenders enforce penalties for early repayment of loans a loan early. These penalties can add significantly to the total loan balance if a borrower decides to settle their debt before the agreed-upon term. Understanding the terms of your loan agreement regarding prepayment is crucial to avoid unexpected increases in your loan balance.

Loan Terms and Repayment Period

Understanding the intricacies of loan terms and repayment options is crucial for managing how these factors can increase your total loan balance. This section delves into the length of loan terms, interest-only payments, and deferred payment options, offering insights into each’s potential impacts.

Length of Loan Term

The duration of a loan term Contributes significantly to shaping the total expenses associated with borrowing. A longer loan term might reduce monthly payments. Still, it can dramatically increase the total interest paid over the life of the loan, thereby inflating your total loan balance. It’s essential to balance the need for manageable payments with the desire to minimize long-term interest costs.

Interest-Only Payments

Interest-only payment options allow borrowers to pay only the interest portion of their loans for a specified period. While this can temporarily reduce the financial burden, it does not decrease the principal amount. Consequently, the total loan balance remains unchanged during the interest-only payment period, potentially leading to higher overall costs once regular payments resume.

Deferred Payment Options

Deferred payment plans enable borrowers to postpone their loan repayments for a certain period. Although appealing to those needing immediate financial relief, this option can increase the total loan balance. Interest often continues to accrue during the deferral period, adding to the principal amount and, ultimately, the total cost of the loan. Considering the long-term implications of deferred payments on your financial health is vital.

Capitalization of Interest

Capitalization of interest is a critical factor that can significantly increase your total loan balance. This mechanism involves adding unpaid accrued interest to the loan’s principal amount, affecting overall costs.

Unpaid Accrued Interest Added to Principal

When unpaid interest is capitalized, it is added to the loan’s principal balance. This process increases the total loan balance and means future interest charges are calculated on a higher principal amount. Consequently, borrowers may face higher overall payments over the life of the loan.

Effect of Capitalization on Student Loans

Interest capitalization is particularly impactful for student loans. It occurs at the end of grace periods, deferment, or forbearance, significantly inflating the loan balance. As the capitalized interest increases the principal, students might pay far more than initially borrowed, extending the financial burden well beyond their academic years. Understanding how and when interest capitalizes is crucial for managing the long-term costs associated with student loans.

Payment Behavior

Payment behaviour directly influences the trajectory of your loan balance, potentially leading to significant increases. This section explores the effects of minimum payments, missed payments, and forbearance on your financial obligations.

Making Minimum or Interest-Only Payments

Opting for minimum or interest-only payments can seem financially manageable in the short term. Still, it may increase your total loan balance. This approach extends the loan’s lifespan and accumulates additional interest, escalating the overall cost of the loan.

Missed or Late Payments

Missed or late payments can have severe consequences, including late fees and increased interest rates, which inflate your total loan balance. Furthermore, such payment behaviour can adversely affect your credit score, making future borrowing more difficult and expensive.

Payment Holidays or Forbearance Periods

While payment holidays or forbearance periods offer temporary relief from financial stress, they can also contribute to a higher loan balance. Interest typically continues to accrue during these breaks. Once payments resume, the accrued interest is added to the principal amount, increasing the total cost of borrowing. It’s crucial to weigh the benefits of temporary relief against the long-term financial implications of these options.

Loan Modifications and Refinancing

Exploring loan modifications and refinancing can reveal avenues to adjust financial obligations. Yet, they also hold the potential to increase your total loan balance. This section delves into how restructuring and refinancing affect your debts.

Loan Restructuring Impacts on Balance

Loan restructuring can provide immediate financial relief by modifying the conditions of your loan, such as prolonging the repayment duration or making alterations to the terms. Lowering the interest rate. While these changes can reduce monthly payments, they may result in a higher total loan balance over time due to the accumulation of additional interest charges on the extended loan term.

Refinancing for a Higher Principal Amount

Refinancing a loan for a higher principal amount than originally borrowed can offer access to extra cash for immediate needs. However, this approach increases your total loan balance, potentially leading to higher monthly payments and a more extended repayment period. It’s crucial to thoroughly contemplate the enduring financial implications. Implications of refinancing for a higher amount, as it could mean paying more interest over the life of the loan.

FAQs

Does extending my loan term affect my total loan balance?

Yes, extending your loan term can increase your total loan balance because it results in more interest accruing over a more extended period, even if your monthly payments become more manageable.

How do interest-only payments impact my loan balance?

Interest-only payments keep your principal balance unchanged during the interest-only period. However, since you’re not reducing the principal, the total cost of the loan can increase due to ongoing interest accumulation.

Can late payments increase my loan balance?

Yes, late payments can lead to additional late fees and potentially higher interest rates, increasing your total loan balance over time.

How does the capitalization of interest affect my loan?

Interest capitalization transpires when outstanding interest is incorporated into your loan’s principal balance, increasing the total amount you owe and resulting in higher future interest charges.

Do payment holidays or forbearance periods lead to a higher loan balance?

Yes, interest usually continues to accrue during payment holidays or forbearance periods. This accrued interest can be added to the principal amount, thus increasing your total loan balance.

Can refinancing my loan for a higher amount increase my total loan balance?

Refinancing for a higher principal amount than you currently owe can provide immediate cash. Still, it will increase your total loan balance, as you’ll have a more significant amount to repay, potentially with added interest.

Conclusion

Several factors can significantly impact and increase your total loan balance, including extending loan terms, opting for interest-only payments, accruing late fees, capitalizing interest, and the choices around payment holidays, forbearance, and refinancing for higher amounts. Each of these actions, while offering short-term financial relief or flexibility, can substantially increase the total cost of the loan. Being mindful of these elements is crucial for managing your debt effectively and avoiding unnecessary financial strain over time.