Yes, you can buy a foreclosure with a VA loan, but the property must meet the VA’s minimum property requirements for safety and livability. This process can offer significant savings, though it may involve additional inspections and paperwork.

Introduction

Purchasing a foreclosed property with a VA loan opens up a unique opportunity for veterans and active military members to become homeowners under potentially favorable conditions. This pathway not only leverages the benefits of VA loans, such as no down payment and competitive interest rates, but also taps into the market of foreclosed homes, which can be priced below market value. However, navigating this process requires understanding specific criteria and readiness to meet the VA’s stringent property standards.

Definition of a VA Loan

A VA loan is a mortgage option provided to American veterans, active-duty service members, and select military spouses in the United States. It is issued by private lenders and backed by the U.S. Department of Veterans Affairs. This type of loan offers several advantages, including no down payment, no private mortgage insurance (PMI), and competitive interest rates. It’s designed to make homeownership more accessible to those serving their country.

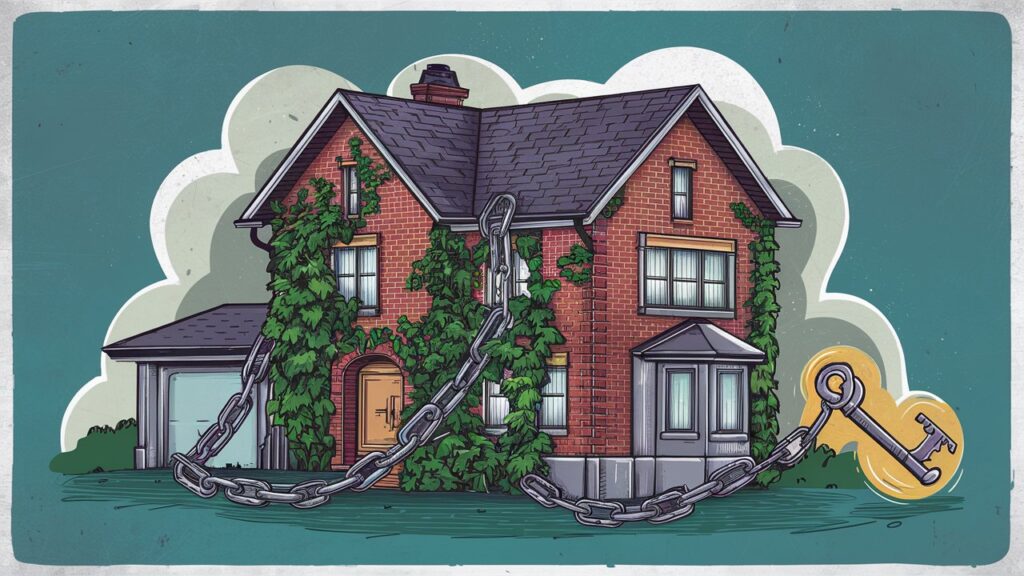

Overview of Purchasing Foreclosures

Purchasing foreclosures involves buying properties the previous owners lost due to failure to meet their mortgage obligations. These properties are often sold below market value, making them attractive to buyers looking for a deal. However, buying a foreclosure can come with challenges, such as potential property condition issues and a more complex purchasing process, requiring thorough inspection and awareness of additional costs.

Eligibility for Using a VA Loan to Buy a Foreclosure

Determining eligibility for a VA loan to purchase a foreclosure involves understanding specific criteria and additional property considerations, ensuring a smooth transaction for military service members.

Eligibility Criteria for VA Loans

Eligibility for a VA loan is primarily based on service requirements, including duration and nature of service in the military, National Guard, or Reserves. Applicants must obtain a Certificate of Eligibility (COE) to prove their qualifications. Credit score and income requirements, though generally more lenient than conventional loans, must be met to ensure the borrower’s ability to repay the loan.

Additional Considerations for Foreclosed Properties

When using a VA loan to buy a foreclosure, the property must meet the VA’s minimum property requirements (MPRs). These standards ensure the home’s safety, structural integrity, and livability. Foreclosed properties, sometimes neglected or vandalized, might require significant repairs to meet these standards. Consequently, potential buyers should be prepared for additional inspections and a more rigorous appraisal process. This step is crucial to protect the buyer’s investment and ensure compliance with VA loan requirements for property conditions.

Navigating the Purchase of a Foreclosed Home with a VA Loan

The journey to acquire a foreclosure through a VA loan unfolds in several distinct phases, guiding veterans toward successful homeownership with an informed and strategic approach.

Securing VA Loan Pre-approval

Initiating the process of securing pre-approval for a VA loan is pivotal. This involves evaluating your military service eligibility, financial standing, and borrowing capacity, setting the foundation for your property search, and affirming your seriousness as a prospective buyer.

Identifying Foreclosed Homes

Armed with pre-approval, the quest for foreclosed homes within your financial scope begins. Leveraging the expertise of realtors who specialize in VA loans and foreclosures can efficiently direct you to suitable homes, aligning with the VA’s stringent criteria.

Deciphering VA Loan Property Standards

A thorough understanding of the VA loan’s property standards is essential. These standards are in place to ensure the property is safe, structurally sound, and habitable. Knowing these guidelines helps filter homes that are less likely to qualify and optimize your search efforts.

Making an Offer on a Foreclosed Home

Finding a foreclosure that ticks all boxes leads to the offer stage. This crucial step involves strategizing with your realtor to place a compelling bid that reflects the property’s condition and market worth.

Conducting VA Appraisal and Inspections

Acceptance of your offer triggers the appraisal and inspection phase mandated by the VA. These evaluations serve dual purposes: appraising the property’s market value and scrutinizing it for any defects that might compromise its safety or livability.

Negotiating Repairs

Should the inspection reveal necessary repairs to meet VA standards, it’s time to negotiate. This might mean engaging with the seller over who undertakes the repairs or, in some foreclosure situations, planning to handle them yourself to align with VA’s requirements.

Closing the Deal

The culmination of your efforts is the closing phase, where the loan and home purchase are finalized. This stage consolidates all prior steps into signing official documents, addressing any remaining stipulations, and officially transferring ownership.

Embarking on this pathway demands thorough preparation, resilience, and the support of experienced professionals familiar with VA loans and the foreclosure market. With a comprehensive grasp of each phase, veterans can effectively utilize their VA loan benefits to secure a home, transforming the challenge of buying a foreclosed property into a rewarding achievement.

Advantages of Employing VA Loans for Foreclosed Properties

Tapping into VA loans to acquire foreclosed homes presents unparalleled benefits, offering a smooth and economical pathway to property ownership for our nation’s veterans. This distinctive financial strategy not only eases the journey towards owning a home priced below market rates but also introduces exclusive perks specifically designed to honor the service of military members.

Zero Down Payment Obligation

The standout feature of utilizing VA loans for foreclosures is undoubtedly the zero down payment requirement. This eliminates a significant financial hurdle, enabling veterans to transition into homeownership without the traditional initial monetary outlay and facilitating a quicker and less burdensome acquisition process.

Capped Closing Costs

With VA loans, the financial load of closing costs is significantly alleviated. The program explicitly caps the fees that can be imposed on veterans during the closing process, allowing for a more budget-friendly conclusion to the home-buying journey and reducing the upfront cash needed to finalize the purchase.

Exemption from Private Mortgage Insurance

A notable advantage of VA loans is the exemption from the Private Mortgage Insurance (PMI) mandate that typically accompanies other loan types when less than a 20% down payment is made. This exemption offers veterans a considerable monthly saving, making the ongoing cost of homeownership more manageable.

Favorable Interest Rates

VA loans are often accompanied by interest rates that are more favorable than those attached to conventional loan options. This benefit can translate into lower monthly mortgage payments and substantial long-term savings, making purchasing a foreclosed property more appealing and financially viable for veterans.

Leveraging these advantages, veterans are positioned to navigate the foreclosure market with significant financial leverage, making the dream of homeownership an attainable reality with fewer financial constraints.

Navigating the Perils and Obstacles

Embarking on the journey to buy a foreclosure with a VA loan presents unique challenges and risks. This path can lead to unexpected repairs, intense competition from other buyers, and potential delays in foreclosure. While the prospect is enticing for veterans seeking homeownership, it demands thorough preparation, patience, and a strategic approach.

Potential for Significant Repairs

Foreclosed homes acquired with VA loans may hide costly surprises that need immediate attention. Often sold “as-is,” these properties might harbor extensive damage or neglect, necessitating a substantial financial and effort investment for restoration to a livable state.

Competition with Other Buyers

The market for foreclosed properties is notably competitive, attracting diverse interested parties. Veterans seeking to purchase a foreclosure with a VA loan may encounter stiff competition, especially from investors armed with ready cash, complicating the bidding and acquisition process.

Possible Delays in the Foreclosure Process

Embarking on the journey of acquiring a foreclosure with a VA loan can be a test of patience due to potential procedural delays. The complexity of the foreclosure process, combined with the meticulous scrutiny required by VA loan stipulations, can extend the timeline significantly, delaying the dream of homeownership.

FAQs

Can you buy a foreclosure with a VA loan?

VA loans can be used to purchase foreclosed properties, offering benefits like no down payment.

Are there special conditions for foreclosures bought with VA loans?

Yes, the property must meet the VA’s minimum requirements concerning safety and structure to qualify.

Can any foreclosed home be bought with a VA loan?

Not all. The home must pass a VA appraisal and meet specific standards.

What risks come with buying a foreclosure using a VA loan?

Potential risks include needing significant repairs, intense competition, and experiencing buying process delays.

How do I start buying a foreclosure with a VA loan?

Secure VA loan eligibility, then find a real estate agent skilled in foreclosures and VA loans.

Can VA loans cover foreclosure repairs?

Yes, VA renovation loans can finance the purchase of a foreclosed home and necessary repairs.

Conclusion

Purchasing a foreclosure with a VA loan offers a viable path to homeownership for veterans, combining the benefits of VA financing with the potential value in the foreclosure market. While the process includes unique challenges such as property condition requirements and competitive buying scenarios, the advantages of no down payment and no PMI, alongside VA’s supportive loan terms, make it an attractive option. Diligence and preparation are essential, ensuring veterans can navigate the complexities to secure a home that meets their needs and VA standards.