To reduce your total loan costs, focus on repaying high-interest loans first, refinancing for lower rates, making extra payments towards the principal, and avoiding extending the loan term. Also, regularly check for ways to reduce fees or negotiate better terms.

Introduction

Navigating loan repayment can often feel overwhelming, yet understanding the strategies to reduce your total loan cost can turn the tide in your favour. You can significantly lessen the financial burden by adopting a proactive approach, such as prioritizing high-interest debts, refinancing at opportune moments, and leveraging extra payments. This guide delves into the nuances of these strategies, offering practical advice to optimize your repayment plan and achieve financial freedom more swiftly.

What is the importance of reducing total loan costs?

Reducing total loan costs is vital for financial health as it decreases the money spent on interest, freeing up capital for other financial goals or investments. It can shorten the loan term, reduce the debt burden quicker, and improve credit scores. Ultimately, minimizing loan costs enables individuals to allocate resources more efficiently, ensuring a more secure financial future and reducing stress associated with long-term debt.

Shop around for the best interest rates.

Shopping around for the best interest rates is critical in reducing your total loan cost. By comparing offers from multiple lenders, you can identify the lowest rates available, potentially saving you thousands over the life of your Loan. This approach minimizes your interest payments and gives you leverage to negotiate better terms. Empower yourself financially by conducting thorough research and choosing wisely to keep your borrowing costs minimal.

Research different lenders

When you’re in the market for a loan, shopping around for the best interest rates is not just a suggestion—it’s a necessity. Research different lenders, including banks, credit unions, and online platforms. Each lender offers unique benefits and rates influenced by their operational models and customer focus. This initial step can uncover options you hadn’t considered, potentially offering more favourable terms or lower interest rates.

Compare interest rates and terms.

Next, compare the interest rates and terms presented by these lenders meticulously. Look beyond the headline rate to understand fees, repayment schedules, and penalties. This comparison sheds light on the total cost of the Loan, revealing the most economical choice over the Loan’s lifespan.

Negotiate for a lower rate.

Finally, don’t hesitate to negotiate for a lower rate. Armed with offers from competing lenders, use this information as leverage to secure a more advantageous deal. Lenders are often willing to adjust terms to win or retain your business. By diligently following these steps, you can significantly reduce your loan costs, ensuring you secure the best possible financial arrangement.

Choose the proper loan term.

Choosing the proper loan term is essential for balancing monthly payments and total interest costs. A shorter term means higher monthly payments but less interest over the life of the Loan. Conversely, a longer term lowers monthly payments but increases total interest paid. Assess your financial situation and goals to select a term that aligns with your ability to pay and minimizes overall costs, ensuring a manageable and cost-effective loan experience.

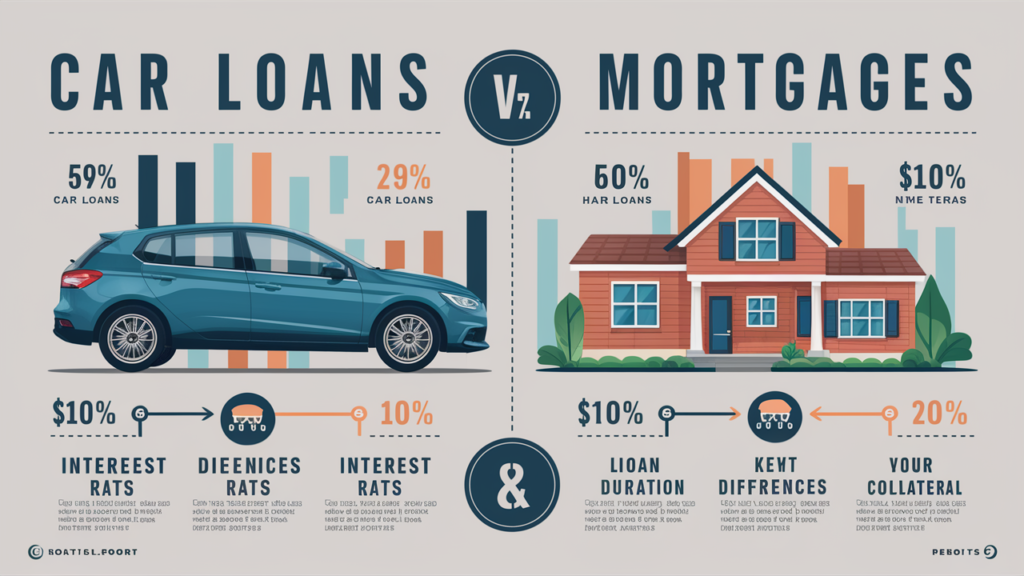

Shorter loan terms vs. longer loan terms

Choosing the proper loan term is a pivotal decision that significantly impacts your financial health. Shorter loan terms, while boasting higher monthly payments, lead to substantial savings on interest costs over the life of the Loan. They are an intelligent choice for those looking to quickly reduce their debt and save money in the long run. On the other hand, longer loan terms offer the advantage of lower monthly payments, making the Loan more manageable on a day-to-day basis but accruing more interest over time, thereby increasing the total cost of the Loan.

Impact of Loan Term on Total Loan Cost

Understanding the impact of the loan term on the total loan cost is crucial. It’s a balancing act between monthly affordability and overall financial efficiency. A shorter term reduces the interest paid but requires a higher monthly outlay, whereas a more extended term eases monthly payments at the expense of increased total interest.

Consider refinancing options

Additionally, consider refinancing options to adjust your loan term in response to changes in your financial situation or interest rates. Refinancing can offer an opportunity to switch to a term that better suits your current needs, potentially lowering your interest rate or monthly payments and offering flexibility in managing your finances. Making an informed choice about your loan term and staying open to refinancing can lead to significant savings and a more tailored financial strategy.

Make extra payments whenever possible in the Loan.

Making extra payments on your Loan whenever possible is a powerful strategy to reduce debt faster and save on interest costs. Paying more than the minimum required amount directly decreases the principal balance, shortening the Loan’s lifespan and minimizing the interest accumulated over time. This proactive approach enhances your financial flexibility and can lead to significant savings, accelerating your journey toward financial freedom and reducing the overall debt burden.

Benefits of making extra payments

Making extra payments on your Loan offers many benefits, chief among them being the potential to significantly reduce the total interest paid over the life of the Loan. By applying additional funds towards the loan principal, you effectively shorten the loan term, translating to less time for interest to accrue. This speeds up your debt repayment journey and enhances your financial security by freeing up resources for other investments or savings sooner than expected.

Strategies for making extra payments

Strategies for making extra payments include allocating unexpected windfalls, such as tax refunds or bonuses, towards your Loan or simply budgeting for an additional fixed amount to add to your regular payments. Even small, consistent extra payments can have a profound impact over time.

How can extra payments reduce total loan costs?

The mechanism by which extra payments reduce total loan cost is straightforward yet powerful. Each additional payment decreases the principal balance, reducing the amount of interest that can accumulate. This compounding effect means that you pay significantly less interest over time, making extra payments a wise financial strategy for long-term savings and financial health.

Avoid unnecessary fees and charges on the Loan.

Avoiding unnecessary fees and charges on your Loan is crucial for minimizing your overall borrowing costs. Carefully read the loan agreement to understand all potential fees, including late payment penalties, application fees, and prepayment charges. By staying informed and managing your Loan responsibly, such as paying on time and avoiding actions that incur extra costs, you can significantly reduce the financial burden of your Loan, keeping your debt as affordable as possible.

Understand loan fees and charges

Understanding loan fees and charges is crucial for borrowers to avoid unnecessary expenses. These fees can significantly impact the total cost of a loan, including application fees, origination fees, and late payment penalties. It’s essential to carefully review your loan agreement and ask your lender for a detailed breakdown of all charges. This transparency allows you to identify and question any excessive or unnecessary fees.

Negotiate fees with the lender.

Negotiating fees with your lender can also lead to savings. Many borrowers need to realize that some loan fees are negotiable. Approach your lender with confidence and inquire about lowering or waiving certain charges. Demonstrating your knowledge of the loan terms and showing your negotiation skills can persuade lenders to offer more favourable terms.

Look for ways to reduce fees and charges

Actively looking for ways to reduce fees and charges can further minimize your financial burden. Consider setting up automatic payments to avoid late fees, refinancing your Loan for better rates, or choosing a lender with lower administrative costs. By being proactive, informed, and willing to negotiate, you can significantly reduce unnecessary fees and charges associated with loans.

Improve your credit score.

Improving your credit score before taking out a loan can lead to better interest rates and terms. Start by paying bills on time, reducing debt, and avoiding new credit inquiries. Regularly checking your credit report for errors and disputing inaccuracies can also help. Demonstrating financial responsibility over time builds lenders’ trust, potentially saving you thousands in interest over the life of a loan.

Importance of credit score in loan terms

The importance of a credit score in determining loan terms cannot be overstated. Lenders use this numerical representation of your creditworthiness to decide your eligibility for a loan and the interest rates and terms you’re offered. A higher credit score signals to lenders that you’re a low-risk borrower, which can lead to more favourable loan terms.

Ways to improve credit score

Improving your credit score involves several strategic actions. Consistently paying bills on time, reducing outstanding debt, and lowering credit utilization are foundational steps. Regularly monitoring your credit report for errors and addressing them promptly can also significantly enhance your score.

Impact of credit score on total loan cost

The impact of a credit score on the total cost of a loan is profound. Borrowers with higher scores often qualify for lower interest rates, which can dramatically reduce the amount of money paid over the life of a loan. For instance, a lower interest rate could mean saving thousands on a mortgage or auto loan, underscoring the financial benefit of improving your credit score before applying.

FAQs

Can making a larger down payment reduce my loan costs?

A larger down payment can significantly reduce your total loan cost. It decreases the principal amount borrowed, leading to lower interest payments over the life of the Loan.

How does refinancing affect my total loan cost?

Refinancing can lower your total loan cost by securing a loan with a lower interest rate or a shorter term. This can reduce interest over time, though initial refinancing fees should be considered.

Does paying more than the minimum monthly payment help?

Absolutely. Paying more than the minimum monthly payment reduces the principal balance faster, thus lowering the amount of interest accrued over the life of the Loan.

Can negotiating the loan terms with my lender reduce costs?

Yes, negotiating for lower interest rates or waived fees with your lender can reduce your total loan cost. Lenders may offer more favourable terms to maintain a good relationship with reliable borrowers.

How do automatic payments impact loan costs?

Many lenders discount interest rates for borrowers who set up automatic payments. This ensures payments are made on time, avoiding late fees, and can directly reduce your interest rate.

Will improving my credit score before applying for a loan lower my costs?

Yes, improving your credit score before applying for a loan can lead to lower interest rates, reducing the Loan’s total cost. A higher credit score demonstrates to lenders that you are a lower-risk borrower.

Conclusion

Strategic financial decisions and proactive negotiation can reduce your total loan cost. By making larger down payments, refinancing for better terms, exceeding minimum payments, and leveraging automatic payment discounts, borrowers can significantly lower the interest accrued over the life of a loan. Furthermore, negotiating with lenders for more favourable terms and improving your credit score before a loan application can lead to substantial savings. Embracing these strategies empowers borrowers to manage their debt efficiently, turning the dream of financial freedom into an attainable reality.