A car loan is not a mortgage. A car loan is a type of consumer loan that is specifically designed to help finance the purchase of a vehicle.

A car is an essential asset in today’s world. However, not everyone can afford to pay the total cost upfront. That is where a car loan comes in handy. It allows individuals to purchase a vehicle by paying a fixed monthly amount until the entire loan is paid off.

Some people mistakenly believe that a car loan is a type of mortgage. A mortgage is a loan that is used to purchase a property or land. On the other hand, a car loan is a consumer loan that is specifically designed to finance the purchase of a vehicle. We will explore the differences between a car loan and a mortgage to help you understand these two types of loans better.

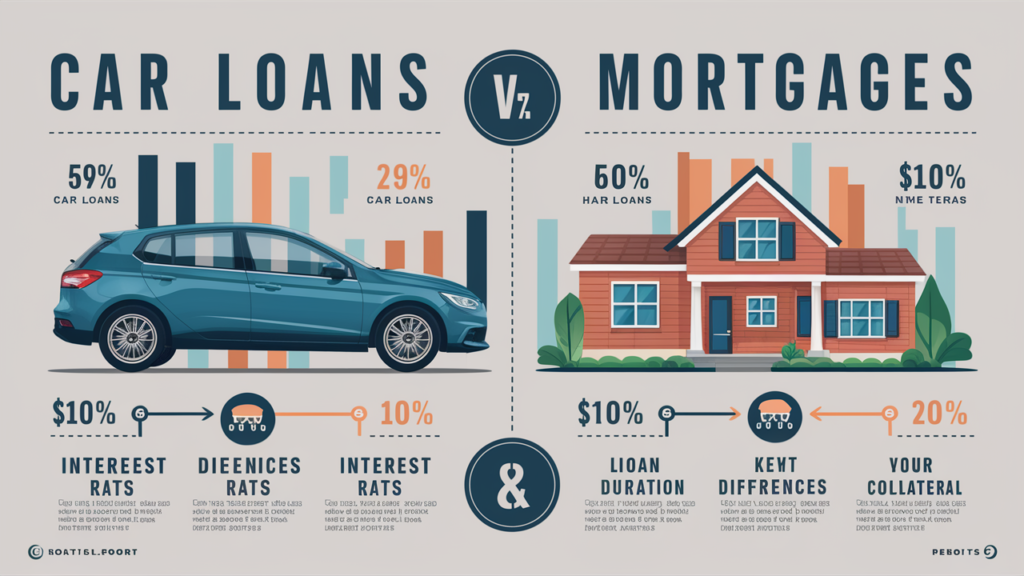

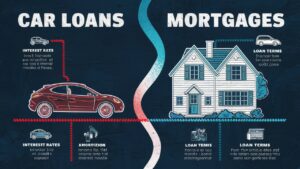

The Differences Between A Mortgage And A Car Loan

Car loans and mortgages are two different types of loans. One of the key differences is the type of collateral they require. A car loan is secured against the car that you are purchasing, while a mortgage is secured against the house you are buying.

Another difference is the loan’s term, or how long you have to repay it. Car loans are often shorter than mortgage loans; they typically last between three and seven years. Mortgages, on the other hand, can last for 15 to 30 years.

The loan amount is also a significant difference between a car loan and a mortgage. Car loans are generally smaller than mortgages, with loan amounts ranging from a few thousand dollars to tens of thousands of dollars. Mortgages, on the other hand, can be hundreds of thousands or even millions of dollars.

Interest rates are another factor to consider. Car loan interest rates are often higher than mortgage rates due to the loan’s shorter term. Your credit score is an important factor in determining your interest rate for both types of loans.

Foreclosure is a process that lenders can use to take back a property when a borrower defaults on the loan. In a mortgage, foreclosure occurs when the borrower fails to make payments. In a car loan, the lender can repossess the car if the borrower doesn’t make payments or otherwise violates the loan agreement.

| Car Loan | Mortgage |

| Secured by the car being purchased | Secured by the house being purchased |

| Loan term typically 3-7 years | Loan term typically 15-30 years |

| Loan amount usually in thousands | Loan amount can be in hundreds of thousands or even millions |

| Interest rates are often higher | Interest rates are often lower |

| Lender can repossess the car if payments are not made | Lender can foreclose on the house if payments are not made |

The Similarities Between Car Loans And Mortgages

Car loans and mortgages seem like very different things, but they have some similarities. One of the most obvious similarities is the idea of monthly payments. Just like with a mortgage, you’ll be making a regular payment on your car loan until it’s paid off. Your credit score will also be checked when you apply for either type of loan. Lenders want to see that you’re a reliable borrower before giving you a loan.

Another thing car loans and mortgages have in common is the required documentation. You’ll need to provide documentation showing your income, employment history, and credit history. This documentation is used to determine if you’re eligible for the loan and to determine the terms of the loan.

While car loans and mortgages have some similarities, it’s important to remember they are different types of loans and should be evaluated differently. It’s important to do your research and understand what type of loan is right for your specific needs.

How To Avoid Confusion Between Car Loans And Mortgages

Car loans and mortgages are two completely different types of loans, even though they both involve purchasing property, be it a car or a house. To avoid confusion between the two, it’s important to do your research beforehand. Understand the terms and conditions of each type of loan, as well as the interest rates, fees, and repayment options. Before signing anything, ask questions to clarify any doubts or uncertainties you may have. Feel free to ask your lender for more information before committing to a loan. Lastly, please read the contract carefully and make sure you understand all the terms and conditions before signing it. This will ensure that you avoid confusion between car loans and mortgages and will help you make informed decisions when it comes to borrowing money.

Frequently Asked Questions

No, auto loans and mortgages are not the same. An auto loan is a loan taken out to purchase a vehicle, while a mortgage is a loan taken out to buy a home or other real estate property. Both loans, however, involve monthly payments and interest charges.

What Is A Car Loan Classified As?

A car loan is a type of secured loan in which the vehicle being purchased serves as collateral for the creditor. It is a loan provided by a financial institution or bank specifically for the purpose of buying a car and is subject to the terms and conditions set by the lender.

Is A Loan Considered A Mortgage?

No, a loan is not the same as a mortgage. A loan is a sum of money borrowed and repaid with interest. In contrast, a mortgage is a loan used specifically to purchase property, with the property serving as collateral for the loan.

What Type Of Credit Is An Auto Loan?

An auto loan is a type of credit that is specifically for purchasing a vehicle. It is typically secured by the car itself and can have a fixed or variable interest rate. Auto loans generally are provided by banks, credit unions, and other financial institutions.

Conclusion

A car loan is not a mortgage. While both involve borrowing money from a lender, a car loan is specifically for purchasing a vehicle, while a mortgage is for purchasing a home. Understanding the differences between the two is important in order to make informed financial decisions.

When it comes to choosing the right type of loan, carefully assess your needs and financial situation to make the best decision for your circumstances.