Small business loans can demand collateral, known as secured or not, making them unsecured. The choice largely depends on the lender’s policies and the business’s financial strength, impacting the terms and flexibility of the financing available.

Introduction

In the diverse landscape of small business financing, loans manifest in two primary forms: secured and unsecured. This pivotal classification revolves around the requirement of collateral—a secured loan demands tangible assets as security, while an unsecured loan does not, relying instead on the borrower’s credit standing. This fundamental division plays a crucial role in shaping the financing strategy of entrepreneurs, influencing both the accessibility of funds and the conditions under which they are granted.

Secured Small Business Loan

Secured small business loans are a pivotal financing option within the financial ecosystem, offering a pathway for businesses to access needed capital. This segment explores the intricacies of secured loans, shedding light on their definition, collateral types, and the advantages and risks they present to borrowers and lenders.

Definition and Characteristics

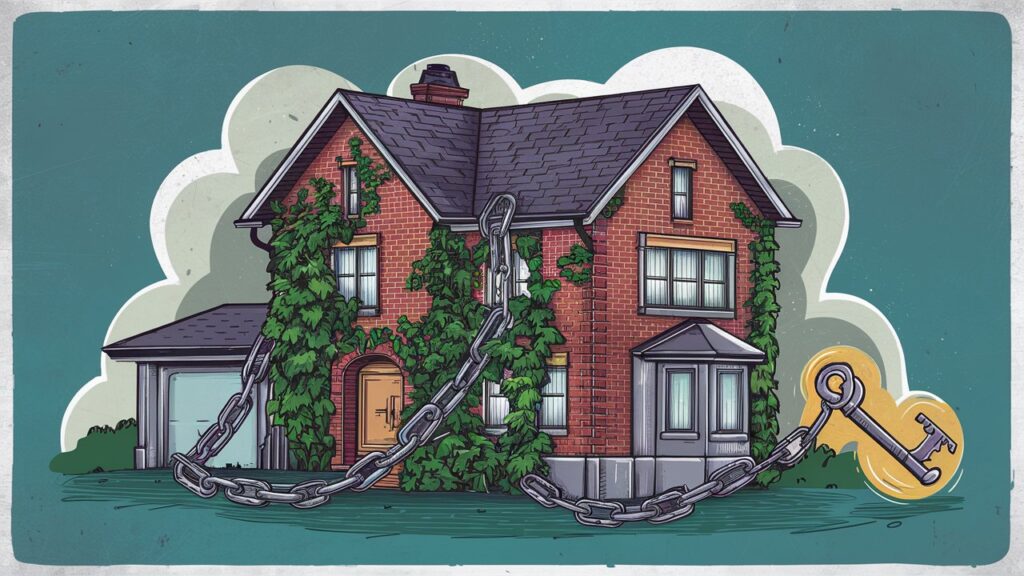

A secured small business loan is characterized by its requirement for collateral—assets pledged by the borrower to secure the loan. This type of loan is marked by its reliance on the borrower’s assets as a safety net for lenders, offering a secured path to obtaining funds. The presence of collateral impacts the loan’s terms, typically resulting in lower interest rates and more extended repayment periods than unsecured loans.

Types of Collateral Accepted

Collateral can vary widely, encompassing real estate, inventory, equipment, and accounts receivable; amonguitability of an asset as collateral depends on its liquidity and value, ensuring that it can cover the loan amount if forfeiture becomes necessary.

Advantages for Borrowers

For borrowers, secured loans often mean access to more significant loan amounts and favourable terms, including lower interest rates. The security provided by collateral can make these loans more accessible to businesses with less-than-perfect credit histories.

Risks for Borrowers

The primary risk for borrowers is the potential loss of assets if they fail to repay the loan. This risk necessitates careful financial planning to ensure the business can meet its repayment obligations without compromising its operational stability.

Advantages for Lenders

From the lender’s perspective, secured loans present a lower risk than unsecured loans. The presence of collateral offers a direct recovery path in case of default, reducing the financial risk and potentially leading to more lenient lending criteria.

Risks for Lenders

While secured loans reduce risk, they are not without their challenges for lenders. The process of liquidating collateral can be time-consuming and costly. Moreover, suppose the collateral’s value depreciates below the loan amount. In that case, lenders may not recover the total value of the loan, presenting a partial risk.

Secured small business loans offer a balanced proposition of risks and rewards for borrowers and lenders. They provide a critical financing avenue for businesses, enabling access to necessary capital while ensuring lenders’ security. The choice between secured and unsecured loans should be made after carefully considering the business’s financial health, future prospects, and the specific needs the loan intends to address.

Unsecured Small Business Loan

Unsecured small business loans represent a critical component of the commercial lending landscape, providing businesses with an alternative route to funding without the need for collateral. This examination delves into their definition, available variety, and benefits and drawbacks for borrowers and lenders.

Definition and Characteristics

Unsecured small business loans are distinguished by their lack of collateral requirements. Instead of securing the loan against physical assets, lenders assess the creditworthiness of the business and its owner(s). These loans are often characterized by shorter repayment terms and higher interest rates than their secured counterparts, reflecting the increased risk to the lender.

Types of Unsecured Loans Available

The spectrum of unsecured loans includes term loans, lines of credit, merchant cash advances, and invoice financing. Each type caters to different business needs, from immediate cash flow solutions to funding for expansion or operational costs without the necessity to pledge assets.

Advantages for Borrowers

Unsecured loans offer businesses the opportunity to secure funding quickly without the need to tie up valuable assets. This can be particularly advantageous for companies with little physical assets to provide as collateral or those seeking fast access to capital to seize growth opportunities.

Risks for Borrowers

The primary risk for borrowers centres on the potentially higher cost of borrowing. Unsecured loans typically have higher interest rates, reflecting the lender’s increased risk. In addition, repayment obligations can severely impact the borrower’s credit score and future borrowing capacity.

Advantages for Lenders

From the lender’s perspective, unsecured loans offer the opportunity to serve a broader range of businesses, especially those lacking collateral but showing strong creditworthiness. The higher interest rates on these loans can also translate to higher potential earnings on the capital lent.

Risks for Lenders

The main challenge for lenders with unsecured loans is the heightened risk of default without the safety net of collateral. This necessitates a more thorough evaluation of the borrower’s financial health and potential reliance on legal means to recoup losses, which can be time-consuming and costly.

Unsecured small business loans play a vital role in the financial ecosystem, offering a lifeline to businesses that may not qualify for secured loans or prefer not to pledge assets. The decision to opt for an unsecured loan should be made after carefully assessing the business’s financial health, the cost of borrowing, and the strategic objectives the loan intends to support. While unsecured loans pose a greater risk for lenders, they also offer the chance to expand their customer base and achieve higher returns, making them an essential part of the lending portfolio.

Comparison between Secured and Unsecured Small Business Loans

Small business financing is diverse, with secured and unsecured loans offering different pathways to capital. This comparative analysis illuminates the distinct features of each, guiding businesses towards the optimal choice for their needs.

Interest Rates

Secured loans typically have lower interest rates due to the reduced risk for lenders backed by collateral. In contrast, unsecured loans, lacking physical assets as security, carry higher interest rates to compensate for the increased risk of default. This variance affects the total cost of borrowing, making secured loans more attractive for cost-conscious businesses.

Loan Amounts

The amount of capital a business can access also varies significantly between the two types. Secured loans often allow for more significant loan amounts, as lenders have a tangible assurance against default. Unsecured loans, however, usually offer smaller amounts, limited by the lender’s risk assessment and the borrower’s creditworthiness rather than asset value.

Approval Process

The approval process for unsecured loans can be faster, bypassing the need to evaluate and appraise collateral. This makes unsecured loans appealing to businesses needing quick access to funds. Secured loans, requiring asset valuation, may entail a longer approval timeline but can be more accessible to companies with less established credit histories due to the collateral involved.

Repayment Terms

Repayment terms for secured loans are often more favourable, featuring longer durations and lower monthly payments, reflecting the security provided by collateral. Unsecured loans, bearing higher risk, typically have shorter repayment terms and higher monthly payments, demanding careful financial planning from borrowers.

Impact on Credit Score

Both secured and unsecured loans can impact a business’s credit score. However, the effects may differ based on the loan’s management. Timely repayments on either can enhance a credit profile, while defaults can harm it. However, the higher payments associated with unsecured loans might pose more significant challenges to maintaining a positive repayment record.

The choice between secured and unsecured small business loans hinges on many factors, from the urgency of funding needs and available assets for collateral to the business’s tolerance for higher interest rates and ability to meet repayment terms. Each type has advantages and challenges, making it crucial for companies to evaluate their financial situation and objectives thoroughly before deciding. This analysis not only aids in selecting the most suitable financing option but also in strategically positioning the business for sustainable growth and success.

FAQs,

What is the main difference between secured and unsecured small business loans?

Secured loans require collateral, like property or equipment, for loan approval. Unsecured loans do not require collateral, relying instead on the borrower’s creditworthiness.

Are interest rates higher for secured or unsecured loans?

Unsecured loans typically have higher interest rates due to the increased risk lenders take on without collateral.

Can I get a more significant loan with a secured or unsecured loan?

Secured loans often allow for more significant loan amounts because the lender has collateral assurance in case of default.

Is the approval process quicker for secured or unsecured loans?

The approval process is generally quicker for unsecured loans since assessing and valuing collateral is unnecessary.

Which loan type offers more flexible repayment terms?

Secured loans usually offer more flexible repayment terms, including longer loan durations and lower monthly payments, due to the lower risk involved for the lender.

How does an unsecured loan affect my credit score compared to a secured loan?

Both types of loans can impact your credit score; however, the higher payments associated with unsecured loans may pose a more significant challenge in maintaining a positive repayment history.

What happens if I default on a secured small business loan?

If you default on a secured loan, the lender has the right to seize the collateral to recover the loan amount, potentially leading to a loss of assets for the business.

Conclusion

In the intricate dance of financing small businesses, the distinction between secured and unsecured loans marks a critical decision point for entrepreneurs. Secured loans, with their collateral requirement, often present a safer harbour for lenders, translating into benefits like lower interest rates and more significant borrowing amounts for the borrower. Unsecured loans, free from the tether of collateral, offer a swift lifeline to funds, albeit at the cost of higher interest rates and the reliance on a solid credit profile. The choice between these financing paths is not merely transactional but strategic, deeply intertwined with the business’s current realities and visions for the future. Entrepreneurs must weigh these options with a keen eye on their venture’s heartbeat—their financial health and operational needs—ensuring the chosen route propels them toward growth and stability.