Failing to report cryptocurrency on taxes can lead to legal consequences, including penalties, fines, or even criminal charges for tax evasion. It may also trigger audits by tax authorities, resulting in additional scrutiny of your financial affairs.

Introduction

Mastering the intricate terrain of cryptocurrency taxation may appear intimidating, but it is a pivotal facet of prudent asset administration. Overlooking the reporting of cryptocurrency transactions on tax filings transcends mere oversight; it constitutes a violation of legal duties with far-reaching consequences. Such negligence may draw unwanted scrutiny from tax authorities, culminating in fines, penalties, and legal proceedings. Grasping the significance of adherence to regulatory standards is imperative for cryptocurrency holders to sidestep these traps and safeguard the integrity of their financial standing.

What is a cryptocurrency, and why must it be reported on taxes?

Cryptocurrency embodies a digital or virtual monetary system fortified by cryptographic safeguards, which effectively deter counterfeiting attempts. It facilitates peer-to-peer transactions through decentralized networks without relying on a central governing entity. The significance of reporting cryptocurrency transactions on tax documentation is that, across numerous legal jurisdictions, profits accrued from its transactions are classified as taxable income. Tax authorities mandate the disclosure of these transactions to guarantee equitable contributions from all stakeholders, thus fostering fairness and bolstering the provision of public services.

Explanation of what cryptocurrency is

Cryptocurrency is a revolutionary digital or virtual currency form that relies on cryptography for security, facilitating secure, anonymous transactions across a decentralized network. Unlike traditional currencies, cryptocurrencies operate without the oversight of a central bank or government, enabling direct peer-to-peer exchanges on a global scale. The innovative nature of cryptocurrency not only challenges conventional financial systems but also introduces a new paradigm in asset management and investment.

Examination of the Taxation of Cryptocurrency Transactions

The taxation framework for cryptocurrency transactions displays divergence across jurisdictions, yet typically, tax agencies regard gains arising from the purchase, sale, or exchange of cryptocurrencies as taxable. Consequently, the profits realized from these transactions become subject to capital gains taxes, akin to the taxation applied to other investment ventures. Taxpayers must disclose these transactions and any corresponding gains or losses on their tax filings, ensuring a faithful depiction of their financial engagements throughout the fiscal year.

Consequences of not reporting cryptocurrency on taxes

Failing to report cryptocurrency on taxes can lead to severe consequences, including hefty fines, penalties, and even legal action for tax evasion. Tax authorities worldwide are increasingly vigilant in tracking cryptocurrency transactions to ensure compliance. Thus, understanding and adhering to tax obligations is essential for cryptocurrency users, ensuring they remain on the right side of the law while engaging in this cutting-edge financial landscape.

Common misconceptions about reporting cryptocurrency on taxes

A common misconception about reporting cryptocurrency on taxes is that transactions are anonymous and thus exempt from taxation. Many believe only profits need to be written, overlooking that exchanges, spending, and mining also trigger tax events. Another fallacy is assuming that losses don’t need to be disclosed, missing out on potential tax benefits. These misunderstandings can lead to non-compliance, underscoring the importance of understanding tax obligations to avoid legal and financial repercussions.

Myth: Cryptocurrency transactions are anonymous and can’t be traced

A widespread misconception about cryptocurrency revolves around the notion that transactions are entirely anonymous and untraceable, fostering the belief that they fall beyond the purview of tax authorities. Nevertheless, advancements in blockchain analysis methods and heightened collaboration between exchanges and governmental entities have substantially bolstered the capacity to monitor cryptocurrency transactions. This fallacy can engender a misguided sense of security concerning tax responsibilities.

The significance of maintaining precise records and reporting every cryptocurrency transaction cannot be emphasized enough. Thorough documentation guarantees individuals can accurately declare their transactions, encompassing purchases, sales, exchanges, and earnings from mining activities. Detailed documentation is essential for the precise calculation of capital gains or losses and serves as invaluable evidence in the event of an audit. Neglecting these duties exposes individuals to legal ramifications and forfeits the chance to leverage potential tax deductions on losses, underscoring the paramount importance of diligence in cryptocurrency tax reporting.

Tips for adequately reporting cryptocurrency on taxes

To properly report cryptocurrency on taxes, diligently track all transactions, including purchases, sales, exchanges, and mining income. Use software tools or spreadsheets for accurate record-keeping. Understand the tax rules in your jurisdiction, as they can vary significantly. Include every transaction, no matter how small, and calculate gains or losses accurately. Consider consulting a tax professional familiar with cryptocurrency regulations to ensure compliance and optimize your tax situation, avoiding potential penalties and maximizing benefits.

Utilizing cryptocurrency tax software

Utilizing cryptocurrency tax software is a highly effective strategy for those looking to streamline the process of reporting their digital asset transactions on taxes. These sophisticated tools can automatically track and classify transactions across multiple exchanges and wallets, accurately calculating gains, losses, and taxable events. This technology simplifies the reporting process and minimizes errors, ensuring compliance with tax laws.

Working with a professional tax advisor

Working with a professional tax advisor with expertise in cryptocurrency can provide invaluable guidance and peace of mind. A knowledgeable advisor can help navigate the complex tax implications of cryptocurrency transactions, offer strategies for tax optimization, and assist in accurately preparing and filing your tax return. This personalized advice is particularly beneficial in the ever-evolving landscape of cryptocurrency taxation.

The Importance of Comprehensive Transaction Documentation

Maintaining thorough documentation of every cryptocurrency transaction is essential. Record transaction dates, amounts, and transaction types retain receipts, exchange records, and wallet addresses. This meticulous record-keeping is vital for validating transactions on tax returns, enabling precise reporting of gains and losses, and preemptively preparing for potential audits. Adhering to these guidelines ensures individuals accurately report their cryptocurrency on tax filings, mitigating the risk of penalties and optimizing their tax positions.

Penalties for failing to report cryptocurrency on taxes

Failure to report cryptocurrency assets on tax documents can result in hefty penalties, ranging from substantial fines to the imposition of interest on unpaid taxes, and in severe cases, the possibility of facing criminal charges such as tax evasion. The severity of these consequences depends on the jurisdiction and the extent of non-compliance. Tax authorities ramp up their endeavors to combat unreported cryptocurrency transactions, emphasizing the critical need for accurate and timely reporting to avoid legal repercussions and the financial burdens of non-disclosure.

Explanation of potential penalties for not accurately reporting cryptocurrency transactions on taxes

The potential penalties for not accurately reporting cryptocurrency transactions on taxes can be significant, encompassing fines, late payment penalties, and interest on the taxes owed. In severe cases, individuals may face criminal charges such as tax evasion, which could result in prison time. The degree of penalty often correlates with the amount of tax evaded and the perceived intent behind the failure to report.

Examples of individuals who have faced the consequences for not reporting cryptocurrency

Several instances exist where individuals encountered significant repercussions for failing to report cryptocurrency holdings. Among these were technology experts, investors, and day traders who underestimated the necessity of divulging their crypto assets. Tax authorities have adopted advanced blockchain analysis tools across regions to uncover undisclosed transactions. For instance, some individuals faced substantial fines and retroactive tax evaluations following investigations that exposed significant disparities between their reported income and the profits derived from cryptocurrency. These cases serve as vivid reminders of the criticality of adhering to tax regulations concerning cryptocurrency transactions.

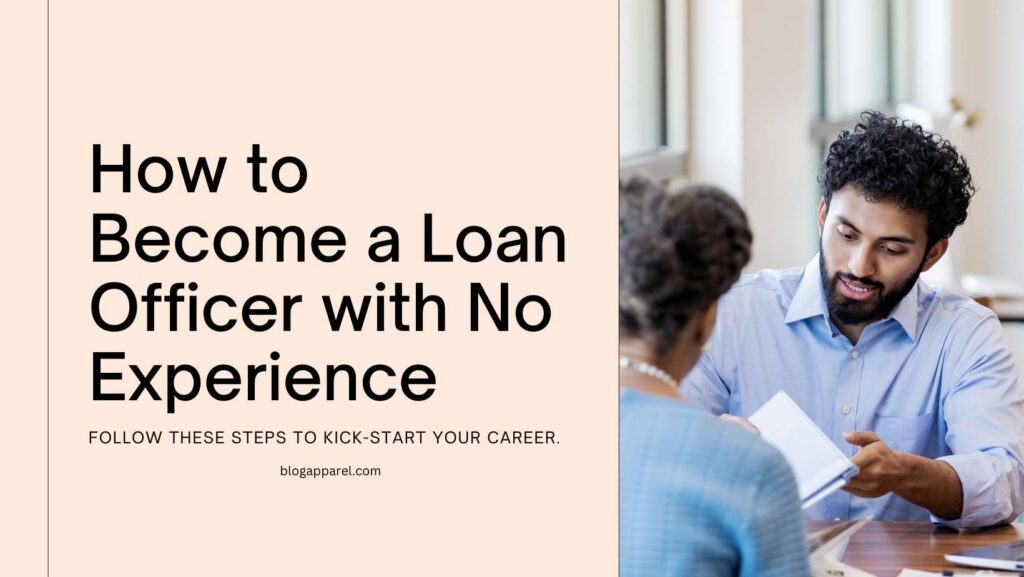

How to report cryptocurrency on taxes

When filing taxes involving cryptocurrency, the initial step consists of assessing the tax ramifications of your transactions, whether they entail capital gains or income. Collate all transactional documentation comprising purchases, sales, exchanges, and mining earnings. Execute precise calculations of your capital gains or losses and income. Employ the relevant tax forms tailored to your jurisdiction, encompassing schedules for capital gains and reports for income. Additionally, contemplate utilizing cryptocurrency tax software or seeking guidance from a tax specialist to guarantee precision and adherence to tax regulations.

Steps to accurately report cryptocurrency transactions on tax forms

For precise reporting of cryptocurrency transactions on tax documents, begin by amalgamating all transaction records, encompassing acquisitions, disposals, exchanges, and mining endeavors. Ascertain the fair market value of each transaction in your native currency at the moment it occurred. Determine your capital gains or losses by juxtaposing the purchase and selling prices. Adhere to the prescribed tax forms to declare capital gains and earnings from crypto assets, adhering to the directives outlined by your regional tax authority. For meticulousness and adherence to regulations, contemplate utilizing cryptocurrency tax software or seeking counsel from a tax expert well-versed in cryptocurrency dealings.

Importance of seeking professional help with cryptocurrency tax reporting

Seeking professional help with cryptocurrency tax reporting is crucial due to the complexity and evolving nature of tax laws surrounding digital currencies. Tax professionals specialized in cryptocurrency can provide expert guidance, ensuring compliance and optimizing tax liability. They help navigate the intricacies of taxable events, capital gains calculations, and applicable deductions, reducing the risk of errors or omissions. Their expertise can safeguard against potential penalties and maximize tax benefits, making their services invaluable for novice and experienced cryptocurrency investors.

Benefits of working with a tax professional when reporting cryptocurrency on taxes

Working with a tax professional when reporting cryptocurrency on taxes offers significant benefits. Their expertise ensures accurate reporting, adherence to the latest tax regulations, and optimization of tax liability. Tax professionals can identify eligible deductions and credits, reducing the tax burden. They also provide peace of mind by minimizing the risk of audits and penalties associated with incorrect filings.

Common mistakes to avoid when reporting cryptocurrency on taxes

Common mistakes to avoid include:

Failing to report all transactions.

Misunderstanding the tax implications of different types of transactions (like swaps and staking).

Incorrectly calculating gains or losses.

Another error is overlooking the reporting of cryptocurrency received as income or gifts, which are taxable events. Engaging a tax professional helps avoid these pitfalls, ensuring comprehensive and compliant tax reporting and highlighting the importance of professional guidance in navigating the complexities of cryptocurrency taxation.

FAQs

What are the consequences of not reporting cryptocurrency on my taxes?

Not reporting cryptocurrency can lead to penalties, interest on unpaid taxes, and potentially criminal charges for tax evasion, depending on the severity and intent.

Can the IRS track my unreported cryptocurrency transactions?

Yes, tax authorities, including the IRS, have tools and methods to track cryptocurrency transactions. They can match transactions to individuals through exchange data and blockchain analysis.

What should I do if I need to report cryptocurrency on past tax returns?

It’s advisable to amend previous tax returns to include unreported cryptocurrency transactions. Consulting with a tax professional can help you navigate this process correctly.

Is there a penalty for mistakenly underreporting cryptocurrency gains?

Yes, underreporting cryptocurrency gains can result in penalties and interest. However, showing that the mistake was due to reasonable cause and not willful neglect may reduce penalties.

Are all cryptocurrency transactions taxable events?

Answer: Most cryptocurrency transactions, including trading, selling, and receiving crypto as payment or rewards, are taxable. However, simply holding cryptocurrency is not considered a taxable event.

Conclusion

Neglecting to disclose cryptocurrency holdings on tax filings poses significant risks, carrying both legal and financial repercussions. With tax agencies bolstering their surveillance and enforcement mechanisms globally, the chances of uncovering undisclosed crypto dealings increase substantially. Consequences may span from monetary penalties and accruing interest on overdue taxes to potential felony charges in extreme instances. This highlights the criticality of meticulously documenting all cryptocurrency activities and seeking expert tax guidance. Ultimately, adhering to regulatory requirements provides reassurance and safeguards the integrity of the financial ecosystem.